Bitcoin's Second Half of 2023: Insights and Predictions

Written on

Chapter 1: Current Market Overview

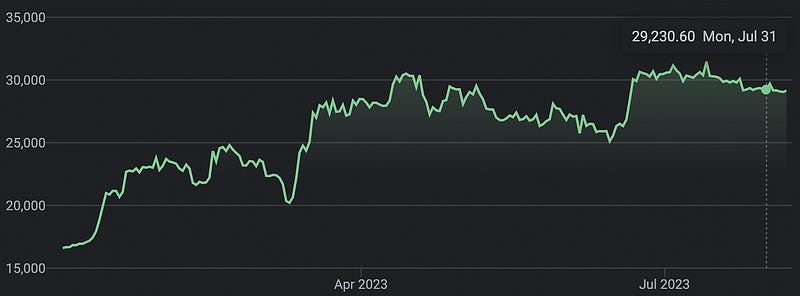

Bitcoin has demonstrated a remarkable increase of 78% year-to-date, concluding July at $29,230.60. Despite a 4% decline during the month, its trading has remained stable, primarily fluctuating above the $29,000 mark since late June.

As August begins, Bitcoin's price has continued to linger just above $29k, paralleling the traditional markets' struggles due to Fitch Ratings downgrading the U.S. long-term foreign currency issuer default rating to AA+. This downgrade was met with skepticism from prominent figures like Warren Buffet, Janet Yellen, and Jamie Dimon, who dismissed it as unwarranted.

This period is reminiscent of the previous summer.

Chapter 2: The Summer Comparison

The summer of 2023 bears a striking resemblance to that of 2022. Last year's summer marked the conclusion of a significant downturn from its all-time highs, which had started over a year earlier. Following Bitcoin's lows in late June 2022, it remained around $20,000 until the FTX collapse in early November. Presently, Bitcoin appears to be consolidating at around $30,000.

Bitcoin's Trading Range: $20,000 to $30,000

Throughout this year, I have consistently stated that Bitcoin is likely to trade predominantly within the $20,000 to $30,000 range. Since January 14th, the price has not dipped below $20,000. Bitcoin operates in four-year cycles linked to the halving events. Historically, it has followed a pattern of three up years followed by a down year. After a significant downturn in 2022 (-81%), Bitcoin has made a robust comeback, with a current increase of approximately 75% for the year.

If the trading range holds, we could witness an end-of-year return between 25-100%. While external factors may influence this, the overall sentiment remains neutral to positive. Events such as BlackRock's application for a spot Bitcoin ETF could bolster long-term prices, while concerns about a potential recession might surface in Q4. Nevertheless, Bitcoin is well-positioned to endure any challenges, likely remaining within the established range.

Chapter 3: The Upcoming Halving Event

The next Bitcoin halving is on the horizon, and we are currently in a pre-halving year. This anticipation brings various implications, most of which the market is yet to fully grasp. Miners are intensifying their operations as they prepare for the upcoming halving, projected to occur in early to mid-2024. This event will halve the rewards for miners securing the network, resulting in fewer Bitcoins entering circulation daily, thereby heightening awareness of Bitcoin's supply-demand dynamics.

Historically, Bitcoin has reached significant price highs following halving events:

- $1,150 — peak after the first halving

- $19,900 — peak after the second halving

- $69,000 — peak after the third halving

The year 2024 appears poised to be crucial for Bitcoin, with the fourth halving potentially aligning with renewed institutional interest. This ongoing cycle underscores Bitcoin's resilience and its status as the most secure computing network globally.

Bitcoin Forecast: Glimpse into the Second Half of 2023!

In this video, we analyze Bitcoin's trajectory for the remaining months of 2023, exploring potential price movements and market influences.

Bitcoin: SHOCKING PREDICTIONS in 2024 - Where Did I Go Wrong?

This video delves into predictions for Bitcoin in 2024, examining past miscalculations and what to expect moving forward.

Thank you for reading! Please note that I am not a financial advisor, and this content should not be construed as financial advice. All opinions expressed are solely my own. For more insights like this, consider subscribing to my weekly newsletter.