Crypto Trends: Insights from Gemini's Global Crypto Report

Written on

Chapter 1: Overview of the Crypto Landscape

Stay updated with the latest developments in the dynamic world of cryptocurrency. Recently, Gemini unveiled its inaugural “Global State of Crypto” report, which explores global attitudes towards digital assets. Additionally, there's buzz about whether Elon Musk will incorporate Dogecoin into Twitter. As the largest Bitcoin conference kicks off in Miami, many are eager to see if Apple has any surprises in store.

Section 1.1: Key Findings from Gemini's Report

Gemini, founded by the Winklevoss twins and one of the most reputable exchanges in the U.S., conducted a comprehensive survey involving 30,000 participants across 20 countries between November 2021 and February 2022.

Some noteworthy insights include:

- 41% of global crypto owners made their first purchase in 2021.

- Among non-crypto owners, 41% expressed intentions to invest in the future, with women making up 47% of this group.

- Individuals from countries experiencing over 50% currency devaluation against the USD in the past decade showed five times more interest in buying crypto.

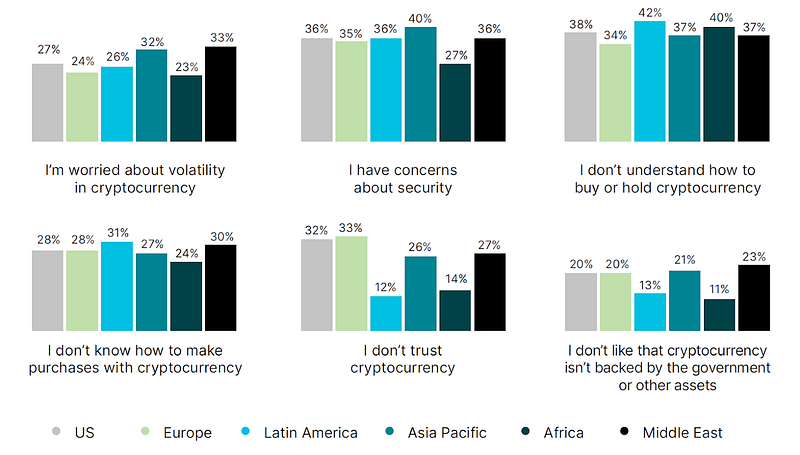

- The primary obstacles for potential buyers include a lack of education and concerns over security.

Subsection 1.1.1: The Future of Money?

When asked if they believe "Crypto is the future of money," an impressive 59% of respondents in Latin America and 58% in Africa agreed, compared to just 12-23% in Europe and the U.S. Furthermore, 79% view cryptocurrency as a "store of value," investing for long-term potential.

The findings suggest that inflation is the driving force behind global crypto adoption, particularly during a year when many governments increased money supply amid the pandemic. Encouragingly, the gender gap in crypto ownership is narrowing as trust in these digital assets grows.

Section 1.2: Market Reactions and Updates

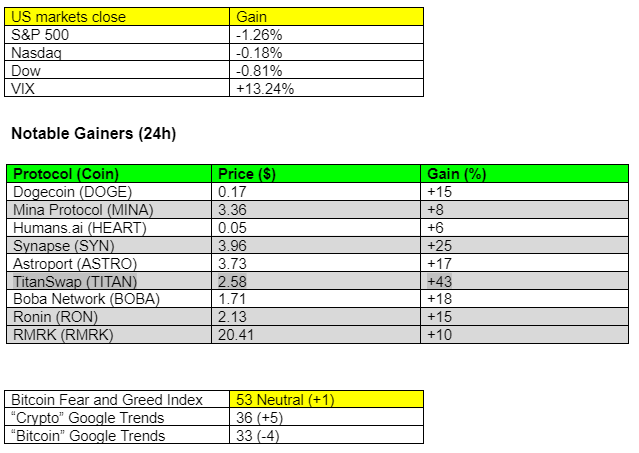

The stock market reacted negatively to comments from Fed officials regarding forthcoming interest rate hikes. The S&P 500 dropped by 1.26%, and the VIX surged by 13.24%, indicating heightened market anxiety. Bitcoin (BTC) mirrored this volatility, dipping to around $44,450 before quickly rebounding.

Chapter 2: Dogecoin and Market Speculations

The focus shifts to Dogecoin (DOGE), which regained attention following Elon Musk's acquisition of a 9.2% stake in Twitter and his appointment to its board. This has fueled speculation about potential integration of DOGE into the platform, resulting in a 16.30% increase in its value and a market cap of $22 billion.

News and Developments

In other news, a bipartisan bill called the El Salvador (ACES) Act was introduced in the U.S. to address risks associated with the country's Bitcoin adoption. Additionally, MicroStrategy acquired another 4,000 BTC, continuing its bullish stance.

The latest Forbes list highlights the wealthiest individuals in the crypto space, with Changpeng Zhao of Binance topping the chart at $65 billion.

Writer’s Perspective

The data from Gemini underscores a growing global interest in cryptocurrency, primarily driven by government fiscal policies. As we look toward the Bitcoin Conference in Miami, speculation surrounds a potential Apple announcement regarding Bitcoin integration into its payment systems.

It's an exciting time for the crypto community, and many anticipate thrilling revelations. So, rise and shine—it's going to be an eventful day!