Creating an Interactive Smart Financial Advisor with Claude 3.5

Written on

Chapter 1: The Motivation Behind the Tool

Managing finances can be a daunting task, and I realized I wasn't alone in this struggle. This awareness sparked an idea: why not develop a tool to help visualize my financial situation? For a long time, I adhered strictly to saving and avoided investments due to my traditional mindset.

However, discovering the world of personal finance through YouTube channels like those of Akshat Shrivastav and Vincent Chan was a game-changer for me. While I appreciated their insights, the high consultation fees made it difficult for me to seek personalized advice. Thus, I decided to create my own AI-powered Financial Advisor using Claude 3.5 Sonnet.

Hello everyone, I'm Kanika, your guide to passive income. Trust me, the potential of leveraging AI for practical solutions is limitless. I've designed various dashboards using this language model and am constantly experimenting, but this particular project stands out as exceptionally beneficial.

You too can craft something similar in just 15 to 20 minutes. Today, I’ll share my journey and the lessons I learned while developing my AI chatbot.

The Concept

My goal was to create a tool that would clearly display my financial inflows and outflows. No more sifting through papers or wrestling with convoluted spreadsheets. I envisioned a colorful interface with charts that would simplify my financial overview. Initially, I sketched my concept, which looked promising in theory, yet I quickly realized I lacked the programming expertise to bring it to life. I thought, “How difficult could it be?”

Learning Through Challenges

My initial attempts were less than successful. I tried to build everything from scratch, which proved overwhelming. After about ten minutes of frustration, I paused to reassess what I truly wanted my dashboard to accomplish. I determined it should:

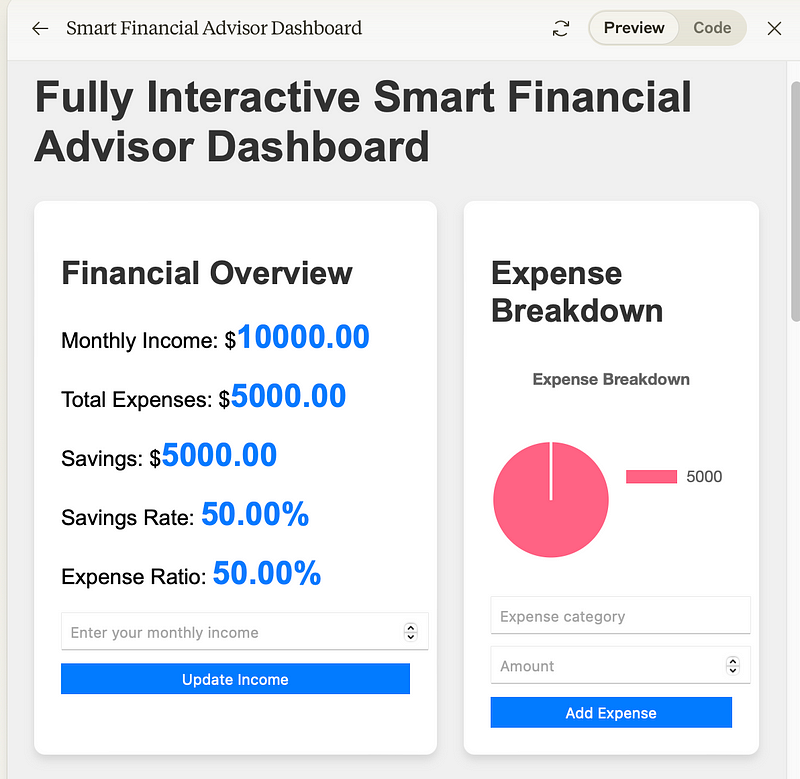

- Display my income and expenses

- Illustrate where my money goes

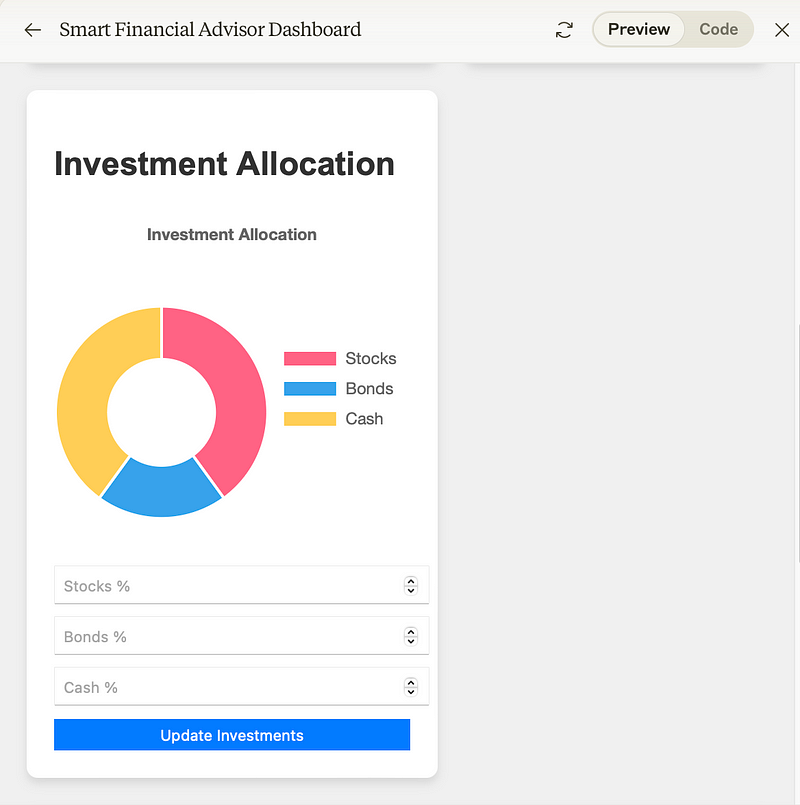

- Help clarify my investments

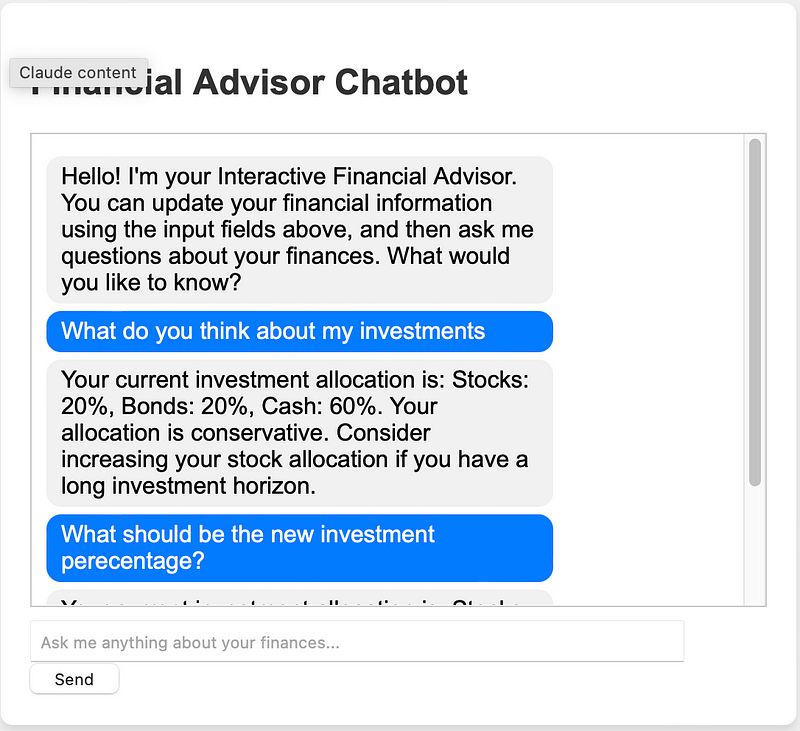

- Offer friendly financial advice

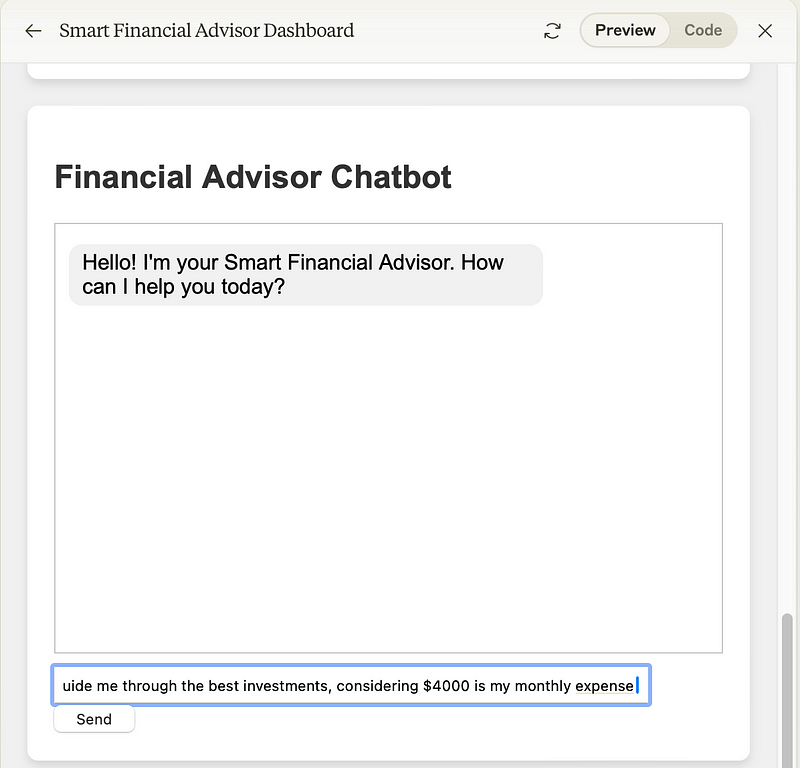

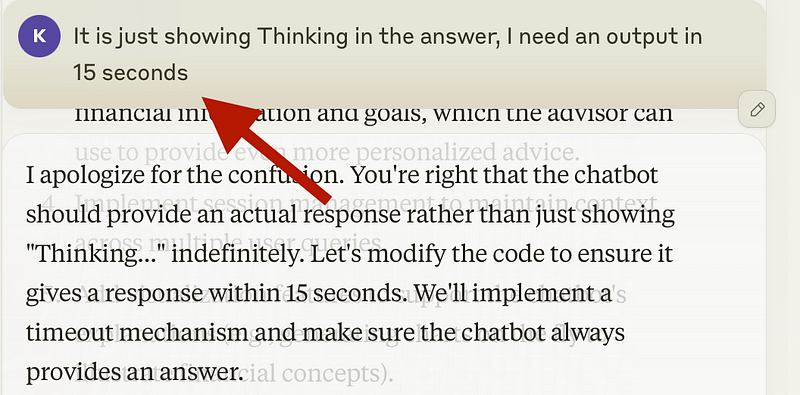

At that point, my idea was stuck in the "thinking phase." This was my first misstep. I then input a prompt to obtain a solution within 15 seconds, and the LLM model promptly adjusted itself.

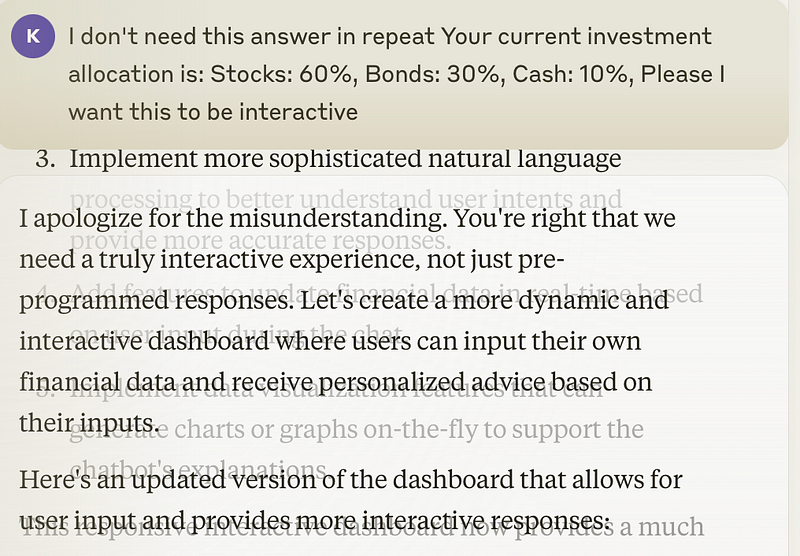

Mistake number two was that my initial dashboard lacked interactivity; it simply repeated the same responses. To remedy this, I provided a new prompt to enhance its interactivity and also switched the coding language from Python to HTML to refine the dashboard further.

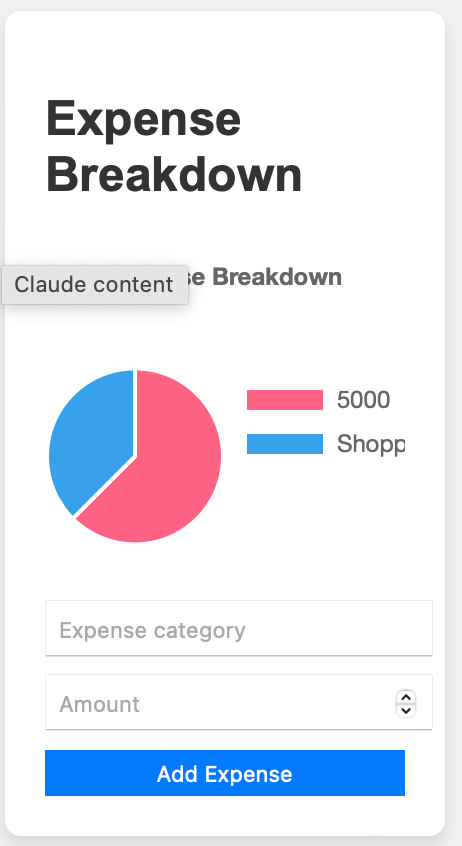

Seeing my expenditures represented in vibrant charts for the first time was exhilarating. It felt like I was finally able to grasp my financial situation. Being able to input my own data and watch the charts adapt was incredibly satisfying.

Crafting the chatbot was enjoyable. I pondered creative ways to encourage spending less on things like online shopping. This experience taught me that managing finances involves not just numbers, but also our mindset and habits.

After dedicating 15 to 20 minutes to this project, my dashboard was complete. I tested it with various inputs and the results were illuminating. I realized I was spending significantly more on shopping than I had anticipated! Although I wasn't saving as much as I wished, this clarity was invaluable.

Mistake number three occurred when I mistakenly entered numbers instead of percentages, which indicated I had a high-risk appetite—a mathematically sound conclusion.

After correcting my error, I was pleased to see that the system accurately indicated my conservative allocation.

Key Takeaways for Developing an Interactive Dashboard with Claude 3.5 Sonnet:

- Clarify Your Purpose: Identify the financial issues your dashboard aims to address.

- Simplicity is Key: Focus on 3-5 essential features you want to track.

- Visual Appeal: Use color schemes and layouts that are easy on the eyes.

- Mobile Compatibility: Ensure the dashboard functions well on smartphones.

- Interactivity is Fun: Incorporate elements that respond to user input.

- Use Everyday Language: Avoid jargon—keep it relatable.

- Plan for the Future: Leave room for growth and additional features.

- Seek Input: Get feedback from friends on what they want in a financial dashboard.

- Personalize It: Allow users to enter their unique financial data.

- Include Help Features: Consider adding tips or a chatbot for clarification.

Remember, the only thing holding you back from creating something remarkable is yourself! Give it a shot.

Lastly, there's a common misconception that LLM models are only for the younger generation. Not true! My father is currently learning to use Claude and ChatGPT for his daily tasks.

I hope you found this article insightful.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Subscribe to my YouTube channel for simple strategies to create sustainable online income. ? CLICK HERE to join the journey!

Let’s connect on LinkedIn or Twitter.

Chapter 2: Video Insights

The first video titled "3 Best Ways To Use Claude 3.5 Sonnet For Businesses" discusses innovative applications of Claude in various business contexts, showcasing its versatility and practical benefits.

The second video, "AI Magic: Claude 3.5 Sonnet Does WHAT for Your Business?! (ChatGPT Can't Compete)," explores the unique advantages of Claude over other AI tools, emphasizing its competitive edge in the business landscape.