# Prepare for the Next Big Crypto Surge: Invest Early in Bitcoin

Written on

Understanding Your Crypto Investments

Do you often find yourself doubting your cryptocurrency investments amidst a sea of uncertainty and fear? This is a common human experience. To navigate this turbulence effectively, it's wise to rely on financial experts, as they often convey similar messages over time. Think of it as illuminating your path with a flashlight in darkness.

Renowned economist Raoul Pal is optimistic about the cryptocurrency revolution. His insights are valuable due to his extensive knowledge of financial markets, earning him a reputation as a leading Business Cycle Economist and Economic Historian. He adeptly simplifies complex concepts and utilizes historical examples to predict future market behaviors.

According to Pal, if you're contemplating an investment in Bitcoin, it’s essential to assess the current phase of the economy’s “liquidity cycle,” which indicates how much money is circulating for expenditure. He advises against investing all your funds at once; instead, consider starting small through Dollar Cost Averaging. This cautious approach is critical, especially since the economic situation could deteriorate. However, he believes now is an opportune moment to begin investing gradually.

As we approach a recession and negative sentiment looms over various assets, Pal stands out as a beacon of positivity. While you might miss the very bottom of the market, he asserts that prices are unlikely to fall significantly from their current levels, thanks to the ongoing business and liquidity cycles. An influx of capital into the market suggests that asset prices will rise.

If you grasp this concept, you’ll be better equipped to ignore pessimistic sentiments, thereby seizing potential growth opportunities ahead of time.

Bitcoin as a Long-Term Asset

Pal treats Bitcoin as a safeguard for his long-term wealth. While its price fluctuations may seem erratic, he notes that each market low tends to be higher than the previous one, indicating an overall upward trend. He doesn't concern himself too much with short-term volatility; instead, he focuses on accumulating Bitcoin during downturns. These periods of decline signal an economic contraction, wherein money is withdrawn from circulation.

Assets typically depreciate, and interest rates rise, leading to a reduction in disposable income. Nevertheless, it’s crucial to recognize that economic activity will eventually rebound, and in the coming year, monetary policy will likely shift back to expansion.

Thus, Pal recommends increasing your investments during these downturns to capitalize on the subsequent recovery.

Historical Trends and Market Sentiment

Pal emphasizes that during periods of market downturns, a common refrain is “Bubble!” Those who once shouted “Scam! Ponzi!” often turn into buyers in the next market cycle. A long-term perspective is essential; you must endure the lows and filter out the distractions. Avoid using leverage and strive to remain invested.

He points out numerous historical instances where market fluctuations are entirely normal, and liquidity will eventually return if you exercise patience.

“The global liquidity cycle produces significant booms and busts,” Pal explains. “Each time there’s a boom, those outside the market proclaim ‘Bubble!’ and, indeed, prices do collapse, leading to the ‘It’s a scam! It’s a Ponzi! It’s never coming back!’ narrative. However, prices never revert to their previous lows.”

He provides examples from past cycles, including:

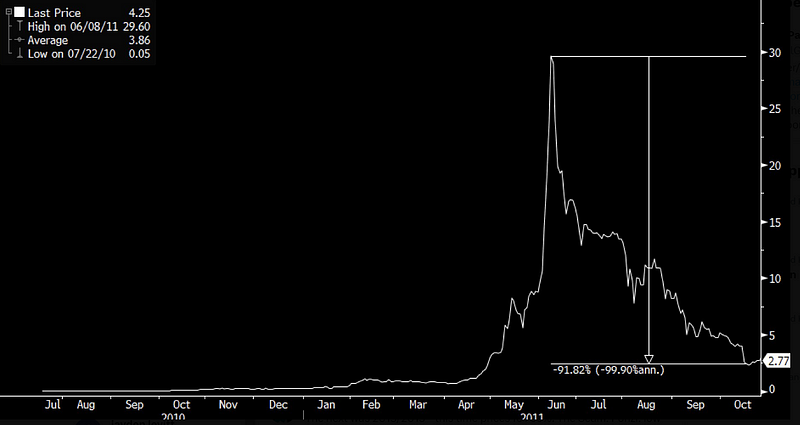

- The 2010/11 cycle, where prices plummeted by 92%.

- The 2013/2015 downturn, with an 85% drop.

- The 2018 crash, resulting in an 83% decline.

These historical references illustrate that even after significant downturns, the market ultimately recovers.

Pal notes that the recent collapse of CeFi and FTX has led to another “Scam! Ponzi!” phase. Many investors exit the market during these periods only to return in the next bull cycle.

The overarching influence of the global money supply drives these boom/bust cycles. When liquidity is scarce, bankruptcies surge, and speculative investments dwindle. This is when the market reveals its vulnerabilities.

Despite the noise surrounding “Scam! Ponzi!” accusations, the network growth in Bitcoin is remarkable, averaging 125% annually. Each downturn ultimately sets the stage for substantial price increases, fueled by returning liquidity and ongoing network expansion.

Final Insights

Pal has drawn insights from the last three significant crypto crashes to forecast future market behavior. It’s important to remember that Bitcoin has yet to navigate a major quantitative tightening or recession, introducing uncertainties.

Signs indicate that younger investors are increasingly viewing Bitcoin as a safe haven, similar to gold during turbulent times. Additionally, the continuous debasement of currencies suggests that more capital will flow into the system, which is bullish for Bitcoin.

Although you may not pinpoint the market's lowest point, a massive crypto surge is on the horizon. To safeguard against the erosion of currency value, you have two choices: sit on cash or invest in assets early.

I know which option I prefer.

Join my Free Newsletter today to stay informed with daily insights from top experts in Crypto, Business, Finance, and Technology.

Disclaimer: This article serves informational purposes only and should not be construed as financial, tax, or legal advice. Consult a financial professional before making any significant financial decisions.